Some Ideas on Pacific Prime You Should Know

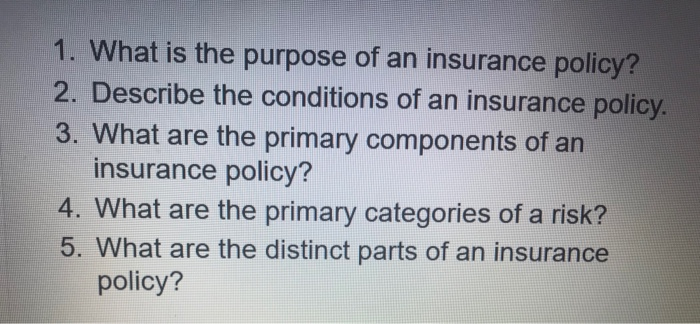

Some Ideas on Pacific Prime You Should Know

Blog Article

Rumored Buzz on Pacific Prime

Table of ContentsFascination About Pacific PrimeThe Single Strategy To Use For Pacific PrimeSome Of Pacific PrimeThe Best Strategy To Use For Pacific PrimeA Biased View of Pacific Prime

Insurance coverage is a contract, stood for by a plan, in which an insurance policy holder obtains economic defense or compensation against losses from an insurance firm. Most individuals have some insurance policy: for their vehicle, their residence, their health care, or their life.Insurance coverage also helps cover prices connected with responsibility (legal obligation) for damages or injury caused to a third party. Insurance policy is an agreement (plan) in which an insurance company compensates another against losses from details contingencies or risks. There are several sorts of insurance plan. Life, wellness, home owners, and automobile are amongst the most common forms of insurance coverage.

Investopedia/ Daniel Fishel Numerous insurance plan kinds are readily available, and practically any specific or service can discover an insurance policy business prepared to guarantee themfor a rate. Usual personal insurance coverage types are car, health and wellness, property owners, and life insurance policy. Many people in the USA have at least one of these sorts of insurance, and cars and truck insurance coverage is called for by state regulation.

Pacific Prime for Beginners

Finding the rate that is ideal for you calls for some research. Optimums might be set per period (e.g., annual or plan term), per loss or injury, or over the life of the plan, likewise understood as the lifetime optimum.

There are many different types of insurance. Wellness insurance aids covers routine and emergency situation medical treatment costs, frequently with the alternative to include vision and dental services individually.

Nevertheless, several preventive services might be covered for complimentary before these are satisfied. Health insurance might be bought from an insurer, an insurance policy agent, the federal Health Insurance Industry, offered by an employer, or government Medicare and Medicaid insurance coverage. The federal government no more needs Americans to have medical insurance, but in some states, such as The golden state, you might pay a tax obligation fine if you don't have insurance.

Not known Details About Pacific Prime

The company after that pays all or most of the protected expenses connected with a vehicle accident or other automobile damages. If you have actually a leased vehicle or obtained money to purchase a vehicle, your lending institution or leasing dealer will likely require you to lug vehicle insurance policy.

A life insurance policy policy assurances that the insurance company pays a sum of cash to your beneficiaries (such as a spouse or children) if you die. In exchange, you pay premiums throughout your lifetime. There are 2 major sorts of life insurance. Term life insurance policy covers you for a particular duration, such as 10 to 20 years.

Permanent life insurance policy covers your entire life as long as you continue paying the costs. Traveling insurance coverage covers the costs and losses associated with taking a trip, including journey cancellations or delays, insurance coverage for emergency situation health and wellness treatment, injuries and emptyings, harmed baggage, rental automobiles, and rental homes. Nonetheless, even a few of the best traveling insurer - https://pacificpr1me.edublogs.org/2024/04/02/pacific-prime-your-one-stop-shop-for-insurance-solutions/ do not cover cancellations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance policy is a method to manage your monetary dangers. When you purchase insurance policy, you buy defense against unanticipated economic losses.

The Basic Principles Of Pacific Prime

There are several insurance coverage plan kinds, you can try here some of the most typical are life, health and wellness, property owners, and car. The appropriate sort of insurance for you will certainly depend on your objectives and monetary scenario.

Have you ever had a moment while taking a look at your insurance coverage or purchasing insurance policy when you've assumed, "What is insurance policy? And do I really require it?" You're not the only one. Insurance can be a mystical and confusing thing. Just how does insurance work? What are the advantages of insurance policy? And just how do you discover the most effective insurance for you? These prevail inquiries, and luckily, there are some easy-to-understand responses for them.

Nobody wants something bad to happen to them. Suffering a loss without insurance policy can put you in a hard financial scenario. Insurance coverage is an important monetary device. It can aid you live life with fewer concerns knowing you'll receive monetary help after a catastrophe or accident, helping you recoup much faster.

Fascination About Pacific Prime

And in many cases, like car insurance coverage and workers' compensation, you may be called for by regulation to have insurance in order to protect others - group insurance plans. Discover ourInsurance options Insurance policy is essentially a massive rainy day fund shared by lots of people (called policyholders) and taken care of by an insurance service provider. The insurance policy business utilizes money accumulated (called costs) from its insurance policy holders and various other investments to spend for its procedures and to satisfy its assurance to insurance holders when they sue

Report this page